A 50/50 fault car accident settlement often sounds final, even damning. In reality, shared fault does not cancel compensation, nor does it block Section B accident benefits. and does not mean insurers get the last word. This article helps you to understand how it actually works, what you can still recover, and why many drivers accept less than they should.

What is a 50/50 fault in car accidents, and how do insurers decide it

A 50/50 fault finding means insurers believe each driver contributed equally to the accident. This decision is made during the claims process, not by a judge, and it often happens early, before all evidence has been reviewed.

Insurance adjusters rely on a mix of documentation and internal rules. Police reports carry weight, but they are not determinative. Officers may not witness the collision and often record only what drivers say at the scene. Witness statements matter, yet many accidents occur without neutral observers. Vehicle damage patterns, skid marks, traffic signals, and weather conditions also factor in.

When evidence points in different directions or lacks clarity, insurers frequently default to shared liability. It limits exposure and avoids prolonged disputes.

The process looks systematic on paper, but it is far from infallible.

How Alberta Insurers Decide 50/50 Fault

Insurance adjusters in Alberta follow the Fault Determination Rules outlined in the Insurance Act. When evidence is unclear, such as a “he-said, she-said” at a four-way stop in downtown Calgary, insurers often default to a 50/50 split.

| Factor Insurers Review | How It Influences Fault in Alberta |

| Police Reports | Mandatory for damage over $5,000 (2025/2026 threshold). |

| DCPD Rules | Direct Compensation for Property Damage rules dictate vehicle repair fault. |

| Vehicle Damage | Point of impact helps determine right-of-way violations under the Traffic Safety Act. |

| Dashcam Footage | Increasingly used to overturn “default” 50/50 findings. |

These determinations are administrative, not judicial. That distinction matters later.

How Shared Liability Really Works in Alberta

Shared liability does not mean shared losses across the board. It means responsibility is divided, and compensation adjusts accordingly. In a 50/50 fault car accident settlement, each party is considered partially responsible, which reduces certain damages but leaves others intact.

Pain and suffering damages, future income loss, and long-term care costs usually fall under tort claims. These are the categories affected by fault apportionment. Accident benefits, by contrast, operate independently and remain available regardless of who caused the collision.

Here’s the problem. Many drivers assume shared fault wipes out their claim. Insurers rarely correct that assumption. In reality, liability percentages shape settlement math, not eligibility.

Is a 50/50 accident considered at fault under Canadian insurance law

Under Canadian insurance law, a 50/50 accident is considered partially at fault. That classification triggers contributory negligence rules, which reduce compensation in proportion to fault rather than eliminating it.

In provinces like Alberta, contributory negligence allows injured parties to recover damages even when they share responsibility. A driver found 50 percent at fault can still pursue 50 percent of the eligible damages. Courts, not insurers, have the final authority on fault if a dispute proceeds to litigation.

This distinction often gets lost in claims conversations. Insurance determinations feel final because they control payments, but legally, they remain negotiable.

Who pays for what in a 50/50 insurance claim?

Since the introduction of DCPD (Direct Compensation for Property Damage) in Alberta, the way your car gets fixed has changed:

| Expense Category | Who Pays |

| Vehicle repairs | Under DCPD, your own insurer pays 50% of your repairs (the portion you aren’t at fault for). The remaining 50% is covered only if you have optional Collision Coverage. |

| Medical treatment | These fall under Section B Benefits, which are 100% no-fault. |

| Income replacement | Paid through accident benefits |

| Pain and suffering | You can sue the other driver for the 50% of the value they caused, subject to the Minor Injury Regulation (MIR). |

| Long-term care | Subject to fault apportionment |

This structure often surprises claimants, especially when both insurers delay action while liability discussions continue.

How a 50/50 fault accident affects your settlement amount

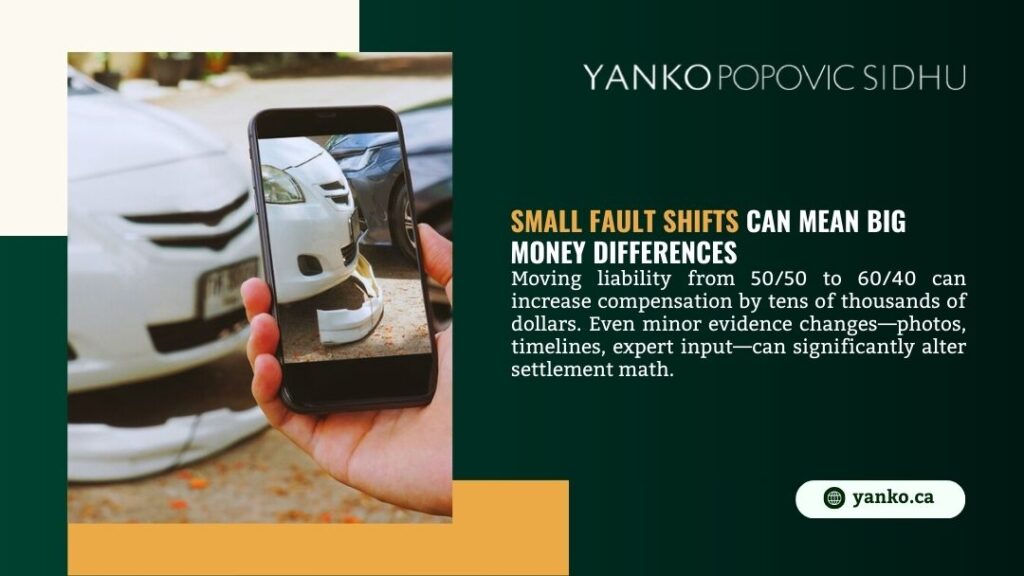

A 50/50 fault car accident settlement reduces non-pecuniary damages by half. Pain and suffering compensation, future income loss, and some out-of-pocket expenses fall into this category. The reduction reflects fault percentage, not injury severity.

That said, severity still drives value. Serious injuries, permanent impairments, and long recovery periods carry weight even when liability is shared. Medical evidence, prognosis, and impact on daily life influence settlement outcomes as much as fault allocation.

This is where many claims unravel. Insurers focus on fault early to anchor negotiations low, while injury consequences continue to evolve. Accepting a settlement before medical stabilization often locks in unnecessary reductions.

Should you accept 50/50 liability or challenge it?

Accepting 50/50 liability closes doors. Once fault allocation is agreed upon, revisiting it becomes difficult, sometimes impossible. Yet many drivers accept shared fault because it feels inevitable.

It isn’t.

Fault findings can shift when new evidence emerges. Independent witnesses may come forward. Accident reconstruction may reveal angles or speeds inconsistent with initial assumptions. Medical timelines can contradict insurer narratives.

Challenging 50/50 liability does not mean heading straight to court. It means pausing, reviewing evidence, and understanding leverage before agreeing to terms that shape the entire settlement.

Accident benefits after a 50/50 accident

Accident benefits remain available regardless of fault. These benefits exist to ensure injured people receive care while liability disputes play out.

| Benefit Type | Coverage Scope |

| Medical and rehabilitation | Treatment and recovery costs |

| Income replacement | Partial wage recovery |

| Family care support | Assistance for dependents |

| Funeral benefits | Available in fatal cases |

Understanding this separation prevents unnecessary pressure to settle early.

What to do after a motor vehicle accident when fault is split

When the fault is unclear or shared, documentation becomes critical. Reporting deadlines must be met. Medical assessments should happen early and consistently. Gaps in treatment often reappear later as arguments against injury severity.

Communication with insurers requires care. Casual statements made shortly after a collision may later be framed as admissions of fault. Evidence preservation, from photos to repair estimates, helps counter premature liability conclusions.

How long do settlements take when the liability is 50/50

Shared fault cases often take longer to resolve. Insurers investigate more thoroughly when responsibility overlaps, and negotiations stall when neither side wants to concede ground.

Timing also depends on medical stabilization. Settlements reached before injuries plateau often undervalue long-term consequences. While delays feel frustrating, premature resolution frequently benefits insurers more than claimants.

How a personal injury lawyer changes a 50/50 outcome

Legal representation reframes the conversation. Evidence is reassessed. Fault percentages are challenged. Settlement discussions gain structure and credibility.A seasoned personal injury lawyer understands how insurers use shared liability as a negotiation tool. That insight shifts leverage, often improving outcomes even when fault remains partially allocated.

Common myths about 50/50 fault accidents

Before the myths take hold, one thing matters: shared fault does not erase rights. It reshapes them.

| Myth | Reality |

| You get nothing if the fault is 50/50 | Compensation reduces, not disappears |

| Insurers make final fault decisions | Courts have the final say |

| You must accept shared liability | Fault can be challenged |

| Accident benefits stop | Benefits apply regardless of fault |

These misconceptions persist because insurers have little incentive to correct them. Understanding the difference changes how claims unfold.

Real-world examples of 50/50 fault car accident settlements

| Scenario | Fault Allocation | Outcome |

| Intersection collision | 50/50 | Reduced damages, full benefits |

| Lane-change impact | 60/40 | Higher settlement leverage |

| Rear-end with sudden stop | Initially 50/50 | The fault later shifted |

Fault findings often evolve once evidence deepens.

Why insurance companies push 50/50 fault findings

Shared fault limits payouts. It discourages litigation. It speeds file closures. From an insurer’s perspective, 50/50 findings balance risk while controlling cost.

That incentive explains why adjusters may lean toward shared liability even when evidence points elsewhere. It also explains why early legal review matters.

When a 50/50 fault finding can be overturned

Fault findings can change. New witnesses, expert reconstruction, inconsistencies in police reports, or contradictions in insurer assessments all open the door to reassessment.

Timing matters. The earlier the evidence is reviewed, the easier it becomes to challenge shared liability before settlement terms harden.

Why this matters more than insurers admit

A 50/50 fault car accident settlement is not a final answer. It is a starting position, often shaped by incomplete information and insurer incentives rather than full legal analysis. Accepting shared fault without review can quietly cost thousands in compensation and years of future security.

That’s why experienced guidance matters. The lawyers at Yanko Popovic Sidhu focus on liability disputes every day. They know when shared fault makes sense and when it doesn’t. If an insurer has labeled your accident 50/50 and something doesn’t sit right, getting clear, experienced advice early can protect far more than a settlement number.